Stick to one or two credit cards.

2. Avoid reaching your maximum credit limits. This is the surest way to make employers think that you are an over spender and you don't know how to control your financial spending habits. This furthermore tells them that you are not financially wise and stable. 3. Avoid having multiple credit card accounts. Stick to one or two credit cards. This financial track record can be the deciding factor when you apply for a loan, car lease, credit card, or mortgage. It pays to know what is on your credit report, quite literally, as a good credit score can save you thousands of dollars. There are three major credit reporting agencies in the United States: TransUnion, Experian and Equifax. Each of these companies keep a separate record of your financial activities.

2. Avoid reaching your maximum credit limits. This is the surest way to make employers think that you are an over spender and you don't know how to control your financial spending habits. This furthermore tells them that you are not financially wise and stable. 3. Avoid having multiple credit card accounts. Stick to one or two credit cards. This financial track record can be the deciding factor when you apply for a loan, car lease, credit card, or mortgage. It pays to know what is on your credit report, quite literally, as a good credit score can save you thousands of dollars. There are three major credit reporting agencies in the United States: TransUnion, Experian and Equifax. Each of these companies keep a separate record of your financial activities.- Repeat this process until you can get an unsecured credit card

- Review Insurance Coverages

- Contribute to Your Retirement Plan

- The webpage includes contact information for credit agencies and how to freeze credit

- Wait until the bill arrives

- Keep an Updated Will

- Can a credit reporting agency deny my application for credit

Some will be understanding, and some won't. It's an unfortunate paradox that a negative credit history can keep you from getting a good job but the old "the rich get richer" adage is definitely alive and well. From a legal stand point a credit check should be used only where the information is necessary for job-related purposes. Especially early in life, starting just after the minimum hiring age, there is not enough history for lenders to verify any type of payment record for the consumer. Younger adults should use what credit they are able to obtain wisely, in order to maintain a good score and avoid starting their financial life on the wrong foot.

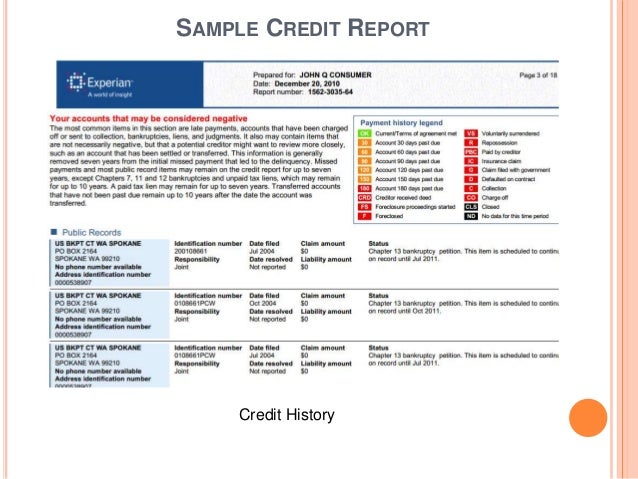

Your credit report contains your name and any name variations, your address, and previous addresses, telephone number (including unlisted number), Social Security number, year and month of birth, and employment information. Information in your report also includes matters of public record such as civil judgments, tax liens and bankruptcies. You have the right to know who has inquired about your credit file or has requested your report over the last six months.

Post a Comment

Post a Comment