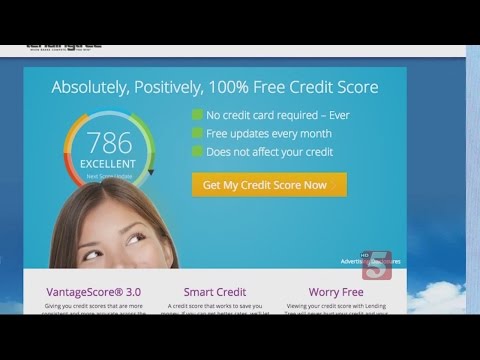

Which companies offer credit report scores for free, The easiest way to get free credit report scores is to use the government site which allows consumers to check their scores from each of the three major sites for free once per year. Companies that offer free credit report scores, like the freecreditreportscore site, require some sort of purchase meaning they're not really free. Your credit score, commonly referred to as a FICO score, is a numerical representation of your current and past financial tendencies. Essentially this score is used to show potential lenders exactly how likely you are to make your payments on time. The higher your score, the more trustworthy you will appear to anyone who is considering whether or not to give you a loan. How is My FICO Score Calculated,

Which companies offer credit report scores for free, The easiest way to get free credit report scores is to use the government site which allows consumers to check their scores from each of the three major sites for free once per year. Companies that offer free credit report scores, like the freecreditreportscore site, require some sort of purchase meaning they're not really free. Your credit score, commonly referred to as a FICO score, is a numerical representation of your current and past financial tendencies. Essentially this score is used to show potential lenders exactly how likely you are to make your payments on time. The higher your score, the more trustworthy you will appear to anyone who is considering whether or not to give you a loan. How is My FICO Score Calculated, The site states that in order to avoid charges, one must end the subscription prior to the end of the trial period. The only way to close the account is to call the customer service number of FreeCreditReport. Where online would one find a free credit score, Choose brands below and we'll send your question to them directly.

The site states that in order to avoid charges, one must end the subscription prior to the end of the trial period. The only way to close the account is to call the customer service number of FreeCreditReport. Where online would one find a free credit score, Choose brands below and we'll send your question to them directly.- Payment History

- 700 to 850 = excellent

- 450 to 550 = low

- 300 - 499 -- Bad Credit

- Credit background

He put my application back through. Miraculously, I was approved! I saved myself hundreds of dollars a month, and thousands of dollars a year by being able to raise my credit scores. The best part is that, because of the techniques I used, it only took a matter of days and not months like the credit bureaus would have you believe. Theres an adage that says “Cash is king.” These days, its more accurate to say that “Credit is king.” Your credit scores have so much impact on your life that it would be catastrophic to take them lightly.

Taking your score from 525 to 675 could possible be done with one strategy in 30 days or less.

560-619 - Risky - Will have trouble obtaining a loan. 500-559 - Very Risky - Need to work on improving your rating. If you want to learn more about credit scores and how to improve yours: Take a look at Phil Turner's Credit Bible. You should find valuable information on fixing and improving your credit.. Taking your score from 525 to 675 could possible be done with one strategy in 30 days or less. It is difficult to answer this question because there are many variables.

Contrary to what most people think, a bad credit score doesn't prevent one from getting a loan. The problem is that the loan would be riddled with large interest rates to the point that it would be unreasonable. On the other hand, by getting and maintaining a good credit score, debtors have better chances of getting lower interest rates on their loans, thereby saving money in the long run. How would one find criminal records online for free, To find criminal records online for free you can go to Criminal Searches, Intelligater, Criminal Background, Vital Records, Public Arrest Records and Black and White Book. Where can one find information on how to get your credit score, One can find information on how to get one's credit score on websites like My Score, Free Scores USA, Money MSN, Wikipedia, Investopedia, Hot to Geek or Consumer.

Post a Comment

Post a Comment