- Correct Inaccurate Information

- Identifying info

- Help Prevent Identity Theft and Fraud

- Open public records

- Avoid Embarrassing Credit Surprises

- Credit background

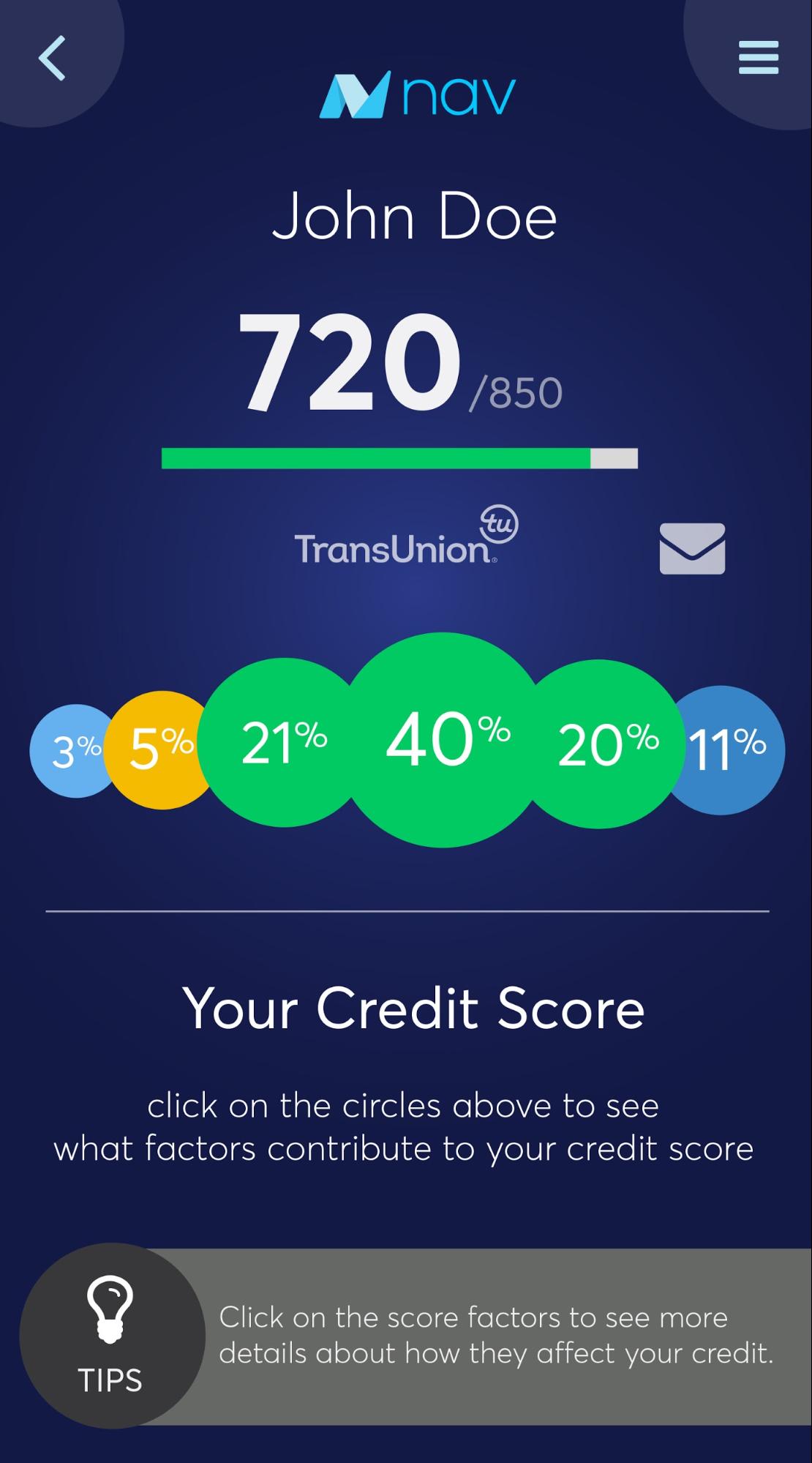

There are several ways to find out your credit report online you can use credit report for free with a 7 day trail or you can go to annual credit report you can recieve that once a year for free. How to check the credit report for free, Free credit reports can be checked by requested it through the three credit bureaus annually.

Hence your details are generally and should be reported to all three firms to maintain a consistency in your financial record. Each of the three firms mentioned have been entrusted with the task of providing citizens with their credit reports, so if you want to get your free credit report, you can request a copy individually from each of the firms.

Hence your details are generally and should be reported to all three firms to maintain a consistency in your financial record. Each of the three firms mentioned have been entrusted with the task of providing citizens with their credit reports, so if you want to get your free credit report, you can request a copy individually from each of the firms.The How-To-Geek wrote an excellent review of many free online credit report services. It is part of his article titled "How To Get Your Free Yearly Credit Reports Without Getting Scammed." How can someone request a free online report of their credit score, Yes, free credit score reports can be requested online. This means contacting the right government and private agencies to request information. In the end, the request for services that provide free background checks where you don't need a credit card has never been bigger. Unfortunately there aren't any "for profit" companies out there that can help you with this. Don't lose all hope though, there are several very inexpensive options available as well as ways you can conduct your own investigations using free resources.

One easy and practical way of reducing the time and effort that you will put in proving your credit worthiness is to use the free credit check that is available online. This system is sanctioned by government and is accepted b y lenders as a gauge on your loan application. With free online credit checks, you, the borrower, can then put more attention and effort at the more important task of repaying the loan and making your money grow. Depending on the originating country of a particular loan, any of these four bureaus could have credit file information for a consumer. Completing the process of receiving a current credit file from any of the bureaus, preferably all three, is essential to managing and maintaining an accurate credit rating. There are many reasons why a business would review a consumer credit file, such as processing a loan application or application for employment.

Also, some places like Equifax and Experian provide a trial offer.

You're Preparing to Buy Or Sign Up To Something That Will Check Your Credit: As mentioned above, a number of organizations will use your score as a way to check whether to do business with you. For example, if you're about to purchase something on credit then you'll want to use a free credit score check to help make sure you'll be approved for a loan. Also, some places like Equifax and Experian provide a trial offer. Where does one go to get a credit check rating, An individual can expect to find information about checking their current credit check rating by going into the local bank and asking to speak with a personal banker. Where can one obtain a free credit report from the three major credit checking agencies, Under United States law, citizens of the United States are entitled to one free credit report per year.

Post a Comment

Post a Comment